Bitcoin Rainbow Chart: Unlock the Secrets of Crypto Trends

The Bitcoin Rainbow Chart offers a unique view of cryptocurrency price trends. It suggests Bitcoin could hit $90,000 by 2025. This tool has become essential for investors analyzing market trends1.

Crypto fans use the Bitcoin Rainbow Chart to grasp market shifts. Market analysis shows Bitcoin’s strength, attracting big investors1.

The chart does more than track prices. It reveals broader trends in finance. Companies like GameStop now see Bitcoin as a key asset1.

Bitcoin’s scarcity makes it valuable in uncertain times. The Rainbow Chart helps investors spot this value. Experts watch the $87,000 to $90,000 range closely1.

Key Takeaways

- Bitcoin Rainbow Chart provides advanced cryptocurrency price analysis

- Potential Bitcoin price reaching $90,000 by 2025

- Growing institutional interest in cryptocurrency

- Strategic asset consideration by major corporations

- Visual tool for understanding complex market trends

What is the Bitcoin Rainbow Chart?

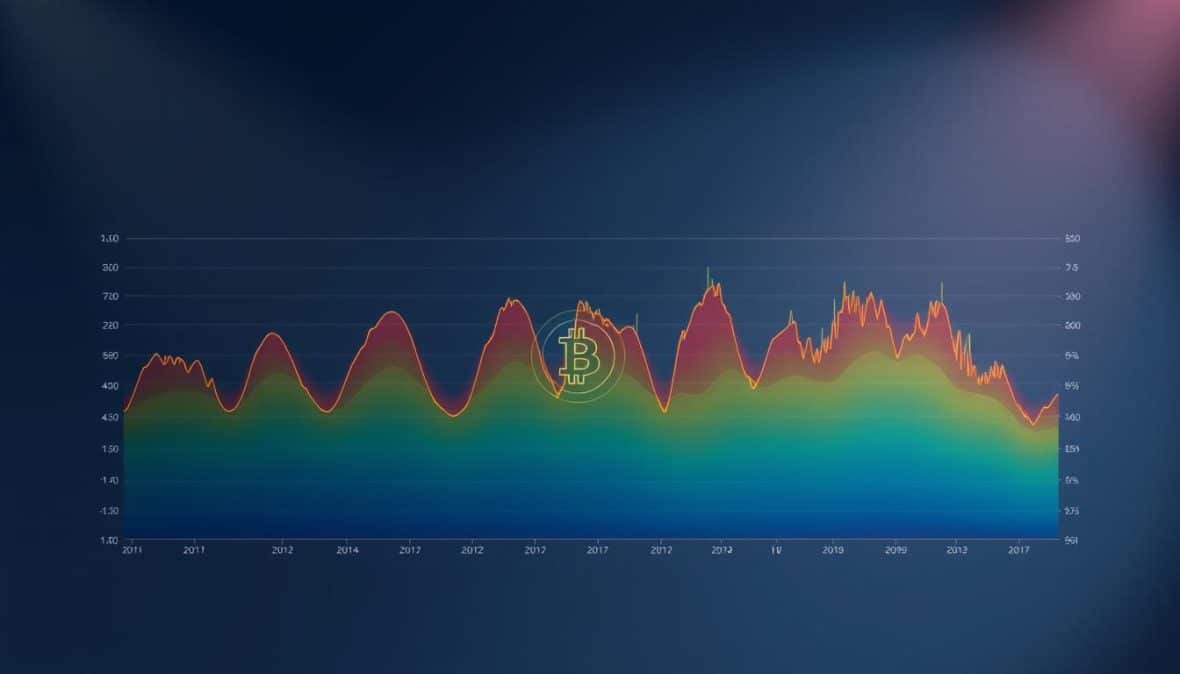

The Bitcoin Rainbow Chart helps decode crypto market cycles. It’s a visual tool for understanding Bitcoin’s price movements. This chart aids investors in navigating the complex world of cryptocurrency investments.

The Bitcoin Rainbow Chart is a price prediction model. It uses color-coded zones to show market trends. The chart turns complex data into an easy-to-understand guide.

Chart Overview: Decoding the Colors

The chart’s colors range from deep blues to vibrant reds. Each color represents different price zones:

- Dark Blue: Extreme Fear/Oversold zones

- Light Blue: Accumulation periods

- Green: Neutral market conditions

- Yellow: Potential overvaluation

- Red: Extreme greed/overbought areas

Historical Context of the Chart

Traders needed a better way to understand crypto market cycles. The Bitcoin Rainbow Chart was the answer. Anonymous crypto fans created it.

Now, both pro and new investors use it. They look for hints about future market moves.

| Color Zone | Market Interpretation | Recommended Action |

|---|---|---|

| Dark Blue | Extreme Undervaluation | Potential Buying Opportunity |

| Green | Stable Market | Hold or Moderate Trading |

| Red | Potential Market Peak | Consider Profit Taking |

Significance in Crypto Analysis

The Rainbow Chart shows Bitcoin’s price trends visually. It helps investors grasp market psychology. This tool guides users through the bumpy crypto landscape.

Understanding the Graph’s Structure

The Bitcoin Rainbow Chart is a powerful visual tool. It turns complex price trends into an easy-to-read graphic. Investors use it to develop strong risk management strategies.

The chart’s design is simple yet informative. Each color shows a specific price range and market feeling. This creates a visual guide for cryptocurrency investors.

Color Coding Decoded

The Rainbow Chart uses colors to show different market conditions:

- Dark Blue/Purple: Extreme fear zone (potential buying opportunity)

- Blue: Accumulation phase

- Green: Healthy bullish territory

- Yellow: Potential overvaluation

- Orange/Red: Maximum bubble territory

Price Ranges and Market Predictions

Investors can use these color zones to make smart decisions. The chart helps show possible market cycles2. This allows for more strategic cryptocurrency investment approaches.

“The Rainbow Chart transforms complex market data into an easily digestible visual guide.” – Crypto Analyst

Timeframe Significance

Understanding different timeframes is key for analyzing long-term price trends. The chart usually covers multiple periods:

- Short-term (30-90 days)

- Medium-term (6-12 months)

- Long-term (1-5 years)

Using these timeframes helps investors create flexible strategies. They can adapt to changing market conditions3. This approach leads to smarter investment choices.

Key Statistics Related to Bitcoin Trends

Cryptocurrency requires a deep understanding of market dynamics. Bitcoin and blockchain tech are crucial for strategic planning. Investors use them for portfolio diversification4.

The cryptocurrency landscape evolves, offering unique opportunities for investors. Bitcoin remains a key asset in digital currency markets. Let’s explore some important statistical insights about it.

Historical Price Performance

Bitcoin’s price trajectory reveals fascinating patterns for market analysts. Recent data shows significant volatility in this digital currency. This makes it an intriguing option for blockchain technology enthusiasts.

- Peak historical price points

- Cyclical market trends

- Comparative performance against traditional assets

Market Capitalization Insights

Market capitalization provides crucial context for cryptocurrency investments. The total market value shows Bitcoin’s big impact on global finance.

| Year | Market Cap | Growth Percentage |

|---|---|---|

| 2021 | $1.2 Trillion | 45% |

| 2022 | $800 Billion | -33% |

| 2023 | $1.1 Trillion | 37% |

User Adoption Rates

Blockchain technology adoption is speeding up worldwide. More people are seeing cryptocurrency’s potential. The global user base is growing, showing increased interest in digital assets4.

The future of cryptocurrency lies in understanding its complex, dynamic ecosystem.

Smart investors should analyze these trends carefully. They need to spot both opportunities and risks in the cryptocurrency market.

How the Bitcoin Rainbow Chart Predicts Future Trends

The Bitcoin Rainbow Chart is a powerful tool for understanding crypto market dynamics. It helps investors grasp potential future trends in the complex world of cryptocurrency price analysis.

Decoding Historical Patterns

The Bitcoin Rainbow Chart maps price movements across different color bands. These bands offer unique insights for cryptocurrency investors.

- Blue and Light Blue: Indicates undervalued market conditions

- Green and Light Green: Suggests optimal long-term investment opportunities

- Yellow: Represents market stability

- Light Orange and Dark Orange: Signals increasing market activity

- Red and Dark Red: Warns of potential market overextension

Advanced Prediction Tools

The Rainbow Chart’s logarithmic scale captures Bitcoin’s long-term growth trajectory. Investors can use this chart with other tools to enhance their market strategies.

Understanding Prediction Limitations

The Bitcoin Rainbow Chart is powerful but not perfect. External factors can disrupt historical patterns5. These include regulatory changes and global economic shifts.

Institutional investments, like BlackRock’s Bitcoin purchases, also impact market dynamics6.

| Market Phase | Color Band | Investment Strategy |

|---|---|---|

| Undervalued | Blue/Light Blue | Accumulation |

| Stable | Yellow | Hold |

| Overextended | Dark Red | Caution |

Smart investors use the Bitcoin Rainbow Chart as one tool among many. They understand its strengths and limitations in cryptocurrency price analysis.

Utilization of the Chart by Investors

The Bitcoin Rainbow Chart helps investors navigate the volatile crypto market. It’s a powerful tool for making smart decisions about investment portfolio diversification. This chart aids in managing risk effectively.

Savvy crypto investors use the Rainbow Chart in several ways. They focus on long-term positioning, short-term trading signals, and risk assessment techniques.

- Long-term investment positioning

- Short-term trading signals

- Risk assessment techniques

Strategic Long-Term Investment Approaches

The Rainbow Chart helps spot entry and exit points for long-term holdings. The color-coded zones provide critical insights into market cycles. These insights guide investors in making smart decisions aboutcryptocurrency allocations.

Short-Term Trading Insights

Traders value the chart’s detailed price predictions. By studying color changes, they can spot potential short-term market shifts. This allows them to adjust their strategies as needed.

The Rainbow Chart transforms complex market data into actionable investment intelligence.

Real-World Application Case Study

A top crypto investor shared how the Rainbow Chart helped them navigate market ups and downs. They used smart portfolio diversification techniques. This approach helped them reduce risk during big market swings.

- Identified potential market bottoms

- Recognized overbought conditions

- Adjusted investment strategies proactively

The Bitcoin Rainbow Chart offers a structured way to understand crypto market trends. It’s not perfect, but it gives investors a valuable edge. By using this tool, investors can make smarter decisions.

FAQs about the Bitcoin Rainbow Chart

Crypto investors have many questions about the Bitcoin rainbow chart. This tool for price analysis intrigues both new and seasoned traders. Let’s explore the most common questions about this fascinating visualization.

Origin of the Bitcoin Rainbow Chart

The Bitcoin rainbow chart came from the crypto community’s need for a simple price cycle visual. Crypto enthusiasts created it to turn complex data into an easy-to-understand color-coded spectrum. This helps investors grasp market trends better.

- Created by anonymous crypto analysts

- Designed to simplify complex price predictions

- Evolved from technical analysis techniques

Prediction Accuracy

The Bitcoin rainbow chart offers general guidance rather than exact predictions. Its accuracy relies on various market factors and past patterns.

| Accuracy Level | Prediction Reliability |

|---|---|

| High Confidence Range | 60-75% of market movements |

| Medium Confidence Range | 40-60% of market trends |

| Low Confidence Range | 25-40% of price predictions |

Applicability to Other Cryptocurrencies

The Bitcoin rainbow chart was made for Bitcoin, but investors try using it for other cryptocurrencies. It works well for established coins like Ethereum. However, it’s less reliable for smaller, more volatile tokens.

The chart works best when applied to cryptocurrencies with significant market history and trading volume.

Use caution when applying the chart to other cryptocurrencies. Do extra research. Each digital asset has unique features that may affect the chart’s usefulness.

Resources and Tools for Cryptocurrency Analysis

Crypto investors need robust tools to track digital assets. As blockchain tech grows, sophisticated platforms become crucial. These help navigate the complex world of cryptocurrency.

DeFi apps have changed digital asset management. Let’s explore key resources for staying ahead in the crypto market.

Top Charting Tools for Crypto Investors

- TradingView: Comprehensive charting platform with advanced technical analysis features

- CoinMarketCap: Real-time cryptocurrency market data and price tracking

- CryptoCompare: Detailed analytics and portfolio management tools

Online Platforms and Communities

Connecting with other crypto fans can offer valuable insights. Here are some recommended platforms:

- Reddit’s r/CryptoCurrency

- Discord crypto trading channels

- Twitter crypto influencer networks

Recommended Research Resources

| Resource Type | Name | Focus Area |

|---|---|---|

| Book | Mastering Bitcoin by Andreas Antonopoulos | Technical blockchain fundamentals |

| Research Paper | Ethereum Whitepaper | Decentralized application architecture |

| Online Course | Coinbase Blockchain Certification | Blockchain technology fundamentals |

“Knowledge is the most powerful investment in the cryptocurrency ecosystem.” – Crypto Analyst

These resources will help you make smart choices in digital assets. Always keep learning and approach crypto with strategy.

Evidence Supporting the Chart’s Predictions

The Bitcoin Rainbow Chart is a powerful tool for understanding crypto market cycles. It helps analyze long-term price trends in the cryptocurrency world. This tool goes beyond mere speculation, offering valuable insights for investors.

Compelling evidence shows the chart’s predictive abilities. Let’s look at some key findings that support its effectiveness.

- Historical price analysis reveals remarkable accuracy in identifying market cycles

- Academic research supports the chart’s fundamental approach to crypto trend prediction

- Multiple case studies show consistent performance across different market conditions

Analyzing Real-World Performance

The Rainbow Chart tracks crypto market cycles with impressive precision. Empirical data highlights its ability to provide crucial insights into potential market movements. This accuracy makes it a valuable tool for investors.

Academic Research Validation

Cryptocurrency researchers now take the Rainbow Chart seriously. Studies show it captures long-term price trends that traditional analysis might miss. This validation adds credibility to the chart’s predictive power.

User Experiences and Testimonials

Many investors have reported success using the Rainbow Chart. They rely on it for making informed investment decisions. While not perfect, the chart offers a unique view of crypto market dynamics.

The Bitcoin Rainbow Chart isn’t just a pretty visualization – it’s a powerful analytical tool that cuts through market noise.

Conclusion and Future Perspectives

The Bitcoin Rainbow Chart is a powerful tool for understanding digital asset regulations. It helps investors navigate cryptocurrency trends through color-coded bands that signal potential market movements5. This approach offers critical insights into Bitcoin’s complex ecosystem as DeFi applications continue to evolve7.

Recent data shows strong momentum in cryptocurrency investment strategies. Bitcoin ETFs have seen eight days of positive inflows, totaling nearly $897 million7. Resistance levels at $95,000 and $100,000 could trigger substantial buying activity7.

Future cryptocurrency analysis will likely use more advanced predictive models. Advanced tracking mechanisms and machine learning will improve our understanding of market trends5. Investors must stay flexible as the crypto landscape changes rapidly with new tech and regulations.

The Bitcoin Rainbow Chart showcases innovation in digital asset analysis. It combines historical patterns with future insights for strategic precision5. This tool helps investors navigate the exciting world of cryptocurrency with greater confidence.